IL DoR CRT-61 2011-2025 free printable template

Show details

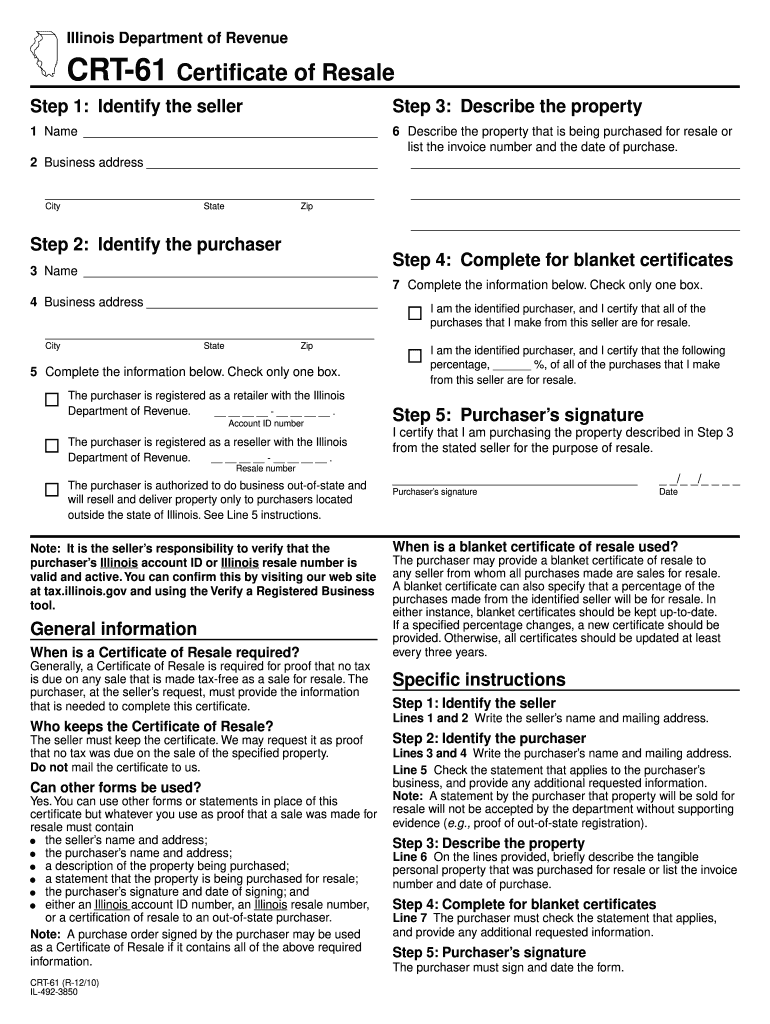

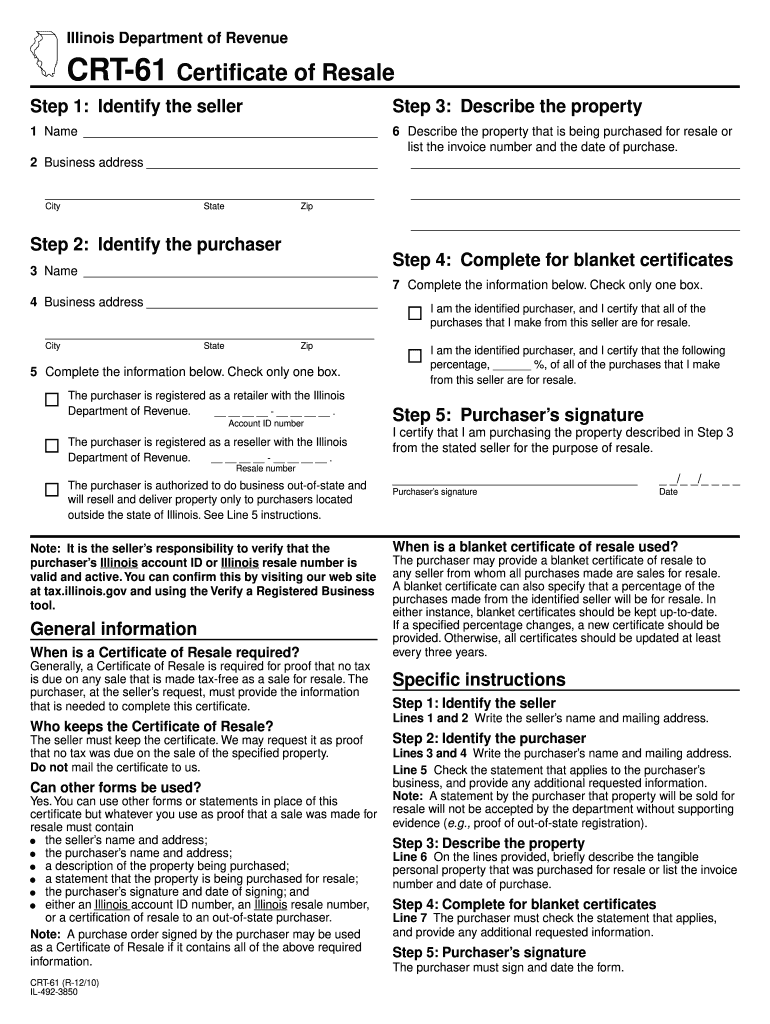

Illinois Department of Revenue CRT-61 Certi cate of Resale Step 1 Identify the seller Step 3 Describe the property 1 Name 2 Business address 6 Describe the property that is being purchased for resale or list the invoice number and the date of purchase. Note A purchase order signed by the purchaser may be used as a Certi cate of Resale if it contains all of the above required information. CRT-61 R-12/10 IL-492-3850 / / Purchaser s signature Date Reset Print When is a blanket certi cate of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign file crt 61 form

Edit your il form crt 61 certificate of resale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing crt 61 fill online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit how to illinois form crt 61. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR CRT-61 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out how to il tax certificate resale form

How to fill out IL DoR CRT-61

01

Download the IL DoR CRT-61 form from the official website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information, including name, address, and contact details.

04

Indicate the type of tax or assessment you are appealing.

05

Provide the specific details regarding the issue you are contesting.

06

Attach any supporting documentation that may strengthen your case.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form.

09

Submit the completed form to the appropriate department as indicated in the instructions.

Who needs IL DoR CRT-61?

01

Individuals or businesses disputing their property tax assessments.

02

Taxpayers seeking to appeal decisions made by the local assessor's office.

03

Anyone who wishes to contest their property tax liability in Illinois.

Fill

crt 61 certificate of resale il form

: Try Risk Free

What is illinois crt 61 form?

Illinois businesses may purchase items tax free to resell. Sales tax is then collected and paid when the items are sold at retail. ... Purchasers may either document their tax-exempt purchases by completing Form CRT-61, Certificate of Resale, or by making their own certificate.

People Also Ask about revenue crt 61

What is certificate exempt sales tax?

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax.

How do I fill out a Illinois CRT 61?

Step 1: Identify the seller. Step 2: Identify the purchaser. Step 3: Describe the property. Step 4: Complete for blanket certificates. Step 5: Purchaser's signature. Step 1: Identify the seller. Step 2: Identify the purchaser. Step 3: Describe the property.

What is an Illinois CRT 61 form?

A CRT-61 certificate of resale for Illinois must include: The name and address of the seller. The name and address of the purchaser. A description of the items that are being purchased for resale. A statement affirming that any items being purchased are being acquired exclusively for resale.

What is an Illinois certificate of resale?

If your business is responsible for paying sales taxes on these types of items, an Illinois certificate of resale allows your business to purchase these goods tax free and then resell them, with the sales tax paid by the buyer. Before you can use a resale certificate, you must register your business with the state.

What is the purpose of a tax exemption certificate?

A sales tax exemption certificate allows a buyer to make tax-free purchases. The purchaser must provide the seller with a completed exemption certificate. Items covered by the exemption certificate are then exempt from sales and use tax. The seller keeps the exemption certificate.

How do I get a sales tax certificate in Illinois?

Illinois requires that you register for a sales tax permit before you make any sales or purchases for resale, or when you hire an employee. 2. How do you register for a sales tax permit in Illinois? Sellers can register online through MyTaxIllinois or mail in form REG-1 to the address specified on the form.

What is an IL CRT 61?

To document tax-exempt purchases of such items, retailers must keep in their books and records a certificate of resale. Purchasers may either document their tax-exempt purchases by completing Form CRT-61, Certificate of Resale, or by making their own certificate.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the blanket certificate of resale illinois electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your how to illinois tax certificate resale in seconds.

Can I create an electronic signature for signing my illinois certi resale in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your illinois tax certificate resale and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out crt 61 certificate of resale illinois form on an Android device?

Use the pdfFiller mobile app to complete your tax crt 61 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is IL DoR CRT-61?

IL DoR CRT-61 is a tax form used by the Illinois Department of Revenue to report specific tax information related to certain tax credits and refunds.

Who is required to file IL DoR CRT-61?

Entities that have claimed tax credits or refunds under Illinois tax laws are required to file IL DoR CRT-61.

How to fill out IL DoR CRT-61?

To fill out IL DoR CRT-61, individuals or businesses must provide required information including their taxpayer identification number, details about the tax credits being claimed, and any supporting documentation as specified in the instructions.

What is the purpose of IL DoR CRT-61?

The purpose of IL DoR CRT-61 is to document and process claims for tax credits and refunds, ensuring compliance with Illinois tax regulations.

What information must be reported on IL DoR CRT-61?

IL DoR CRT-61 requires reporting of taxpayer identification information, specific tax credit details, refund amounts claimed, and any other pertinent information as outlined in the form's instructions.

Fill out your IL DoR CRT-61 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Crt 61 Tax Exempt is not the form you're looking for?Search for another form here.

Keywords relevant to illinois form certificate resale

Related to how to apply for resale certificate in illinois online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.