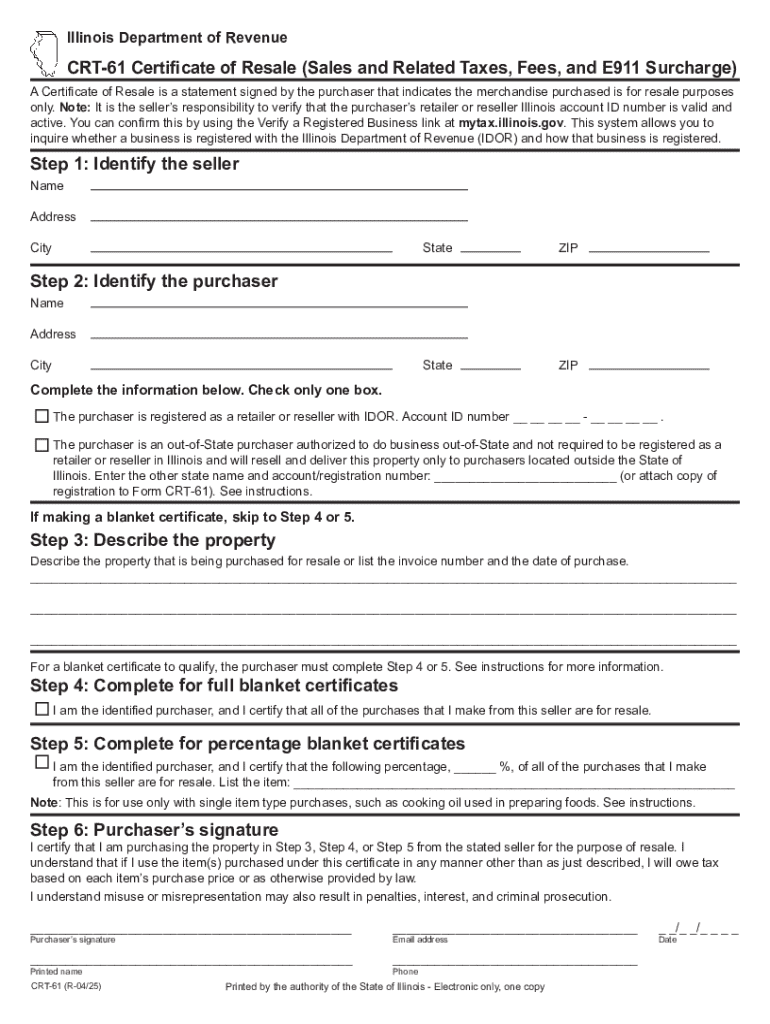

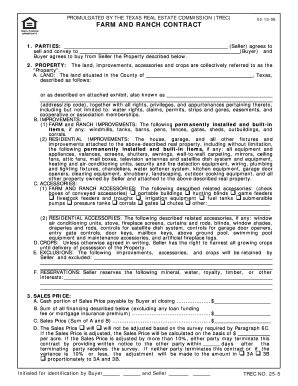

IL DoR CRT-61 2025-2026 free printable template

Get, Create, Make and Sign crt 61 form

How to edit illinois sales tax exemption certificate online

Uncompromising security for your PDF editing and eSignature needs

IL DoR CRT-61 Form Versions

A Comprehensive Guide to Tax Illinois Forms: Focus on -1040

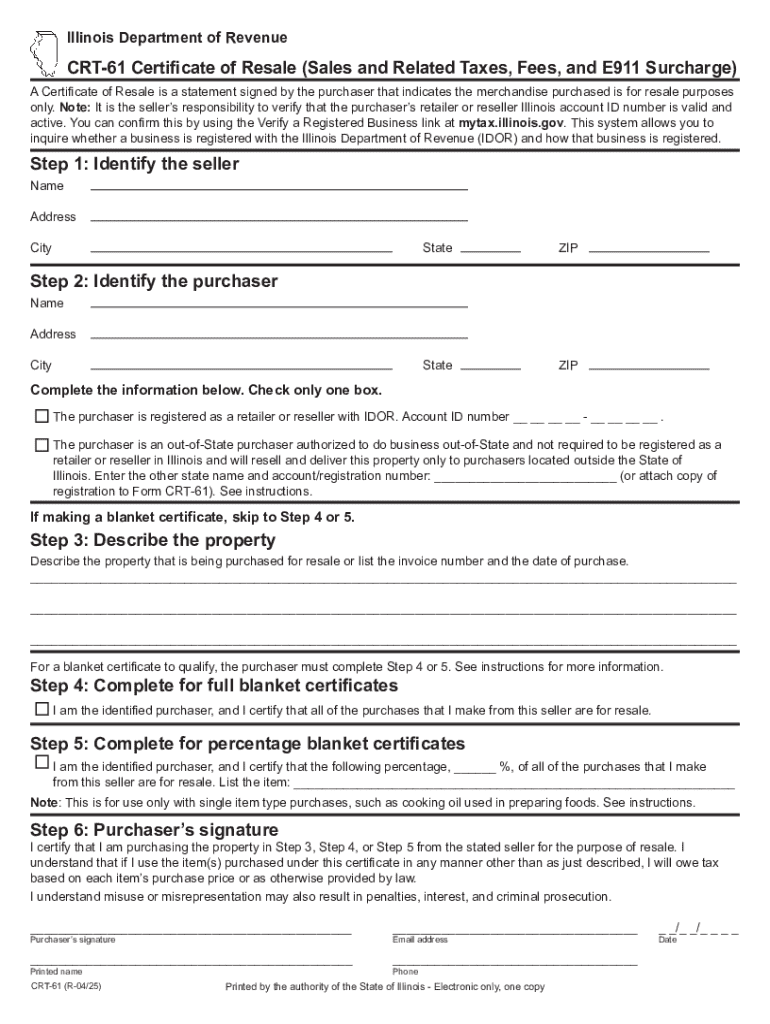

Understanding tax forms in Illinois

Navigating the Illinois tax landscape requires knowledge of specific forms and their unique purposes. The Illinois Department of Revenue oversees the collection of various taxes, including state income tax, sales tax, and property taxes. Each type of tax necessitates the completion of appropriate forms to ensure compliance and avoid potential penalties.

Filling out tax forms correctly is crucial, as inaccuracies can lead to audits and unexpected liabilities. This guide will provide insight into the essential forms for individual and business taxes, notably the IL-1040, primarily designed for individual income tax filing.

Individual forms, like the IL-1040, differ significantly from business forms, necessitating an understanding of specific eligibility requirements, deadlines, and pertinent information to report.

Comprehensive guide to the Illinois form -1040

The IL-1040 form is pivotal for Illinois residents, allowing them to report their income, calculate tax liabilities, and determine refunds due or amounts owed. This form is designed for individuals earning income within the state, including wages, salaries, and investment income.

Eligibility to file the IL-1040 typically includes residents who earned income above a certain threshold and non-residents who earned Illinois-sourced income. If you are unsure whether you should file, it’s advisable to consult a tax professional or refer to the Illinois Department of Revenue’s guidelines.

Filing can be accomplished online through the Illinois Department of Revenue's website, by mailing in a paper form, or in person at authorized locations. Each method has its advantages; online filing tends to be quicker and allows for immediate feedback.

Step-by-step instructions for filling out the -1040

Filling out the IL-1040 can appear daunting, but breaking it down into manageable sections can simplify the process. Here’s a detailed overview of each section that you'll complete.

Section 1: Personal Information

Begin by entering your personal information: full name, address, and Social Security number. Ensuring accuracy here is paramount, as any discrepancies may delay processing.

Section 2: Income Reporting

Next, report all sources of income, including salaries, wages, rental income, and dividends. Compile W-2 forms from employers and 1099 forms for any freelance work or side jobs to ensure accurate reporting.

Section 3: Deductions and Credits

Illinois offers several deductions, including personal exemptions and deductions for property taxes. Familiarize yourself with the state's tax credits, such as the Illinois Earned Income Credit, to maximize your refund.

Section 4: Calculating your tax liability

Use the tables provided in the IL-1040 form or consider utilizing an online calculator to ensure that your calculations are accurate. This section will determine how much tax you owe based on your reported income and applicable deductions.

Section 5: Final steps before submission

Before submission, review your form carefully to identify common errors such as misreported numbers or missing signatures. Ensure you sign and date the form before mailing or submitting electronically.

Utilizing pdfFiller for form -1040

pdfFiller significantly simplifies the process of filling out and managing your IL-1040 form. With its user-friendly platform, you can easily edit PDFs, fill out forms, and even eSign directly from any device.

To use pdfFiller to edit the IL-1040, upload your document to the platform, where you can make changes, fill in necessary fields, and clear your previous entries. The step-by-step editing process is intuitive, allowing you to focus on accuracy.

pdfFiller also offers collaborative features, enabling team members to work together in real time on tax documents. This is particularly advantageous for businesses or families filing together, ensuring everyone is on the same page.

Managing your tax documents post-filing

After filing your IL-1040, properly managing your documents is crucial for future reference. Store your completed tax forms securely in a digital format, leveraging cloud-based solutions for easy access whenever needed.

Digital storage not only reduces clutter but ensures that you have readily accessible copies for any future audits or needs. Implement a document filing system that categorizes forms by year and type for efficiency.

If you discover discrepancies post-filing, you’ll need to file an amended return. Familiarize yourself with the process, including using form IL-1040-X for any significant changes that affect your original submission.

FAQs about Illinois tax forms

Navigating the Illinois tax form system often leads to common questions and concerns. Below are answers to some of the most frequently asked inquiries.

The benefits of using pdfFiller for your tax needs

pdfFiller offers a robust suite of features that cater specifically to the needs of tax season. From document editing and eSigning to cloud storage and collaboration, pdfFiller empowers users to manage their tax forms efficiently.

User testimonials frequently highlight the ease of use and the time savings achieved through pdfFiller’s intuitive interface. This platform is an ideal solution for both individuals managing their personal taxes and teams collaborating on collective submissions.

What is illinois crt 61 form?

People Also Ask about crt 61 certificate of resale form

What is certificate exempt sales tax?

How do I fill out a Illinois CRT 61?

What is an Illinois CRT 61 form?

What is an Illinois certificate of resale?

What is the purpose of a tax exemption certificate?

How do I get a sales tax certificate in Illinois?

What is an IL CRT 61?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send illinois crt 61 resale for eSignature?

How do I complete crt 61 form illinois online?

How do I make edits in illinois crt 61 fillable form without leaving Chrome?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.